The automotive industry is moving into a decade defined by electrification, automation, software-defined vehicles, and an unprecedented level of manufacturing complexity. Yet amid billions of dollars in announcements around new EV platforms and factory modernization, a far more immediate constraint is emerging—one that threatens uptime, quality, and the ability of OEMs and Tier-1 suppliers to transform at the pace the industry now demands.

The real bottleneck is talent.

Specifically, the shrinking pool of skilled maintenance, technical, and manufacturing labor required to operate and support the modern automotive plant.

While technology dominates industry headlines, day-to-day execution remains the differentiator. The ability to maintain robots, troubleshoot automated systems, interpret data, stabilize shift performance, and keep assets running will ultimately define who wins. This is not an HR issue. It is an operational and strategic risk with direct consequences for throughput, quality, transformation, and financial performance.

The Scope of the Crisis

Aging Workforce and Limited Pipeline

The core of the technical workforce—maintenance technicians, electricians, millwrights, controls specialists, robotics techs—is aging. A large portion will retire in the next 5–10 years. At the same time, enrollment in trade and technical programs has declined for more than a decade. Fewer young workers are entering industrial roles, and even fewer possess the hybrid mechanical-electrical-digital skills required in modern automotive plants.

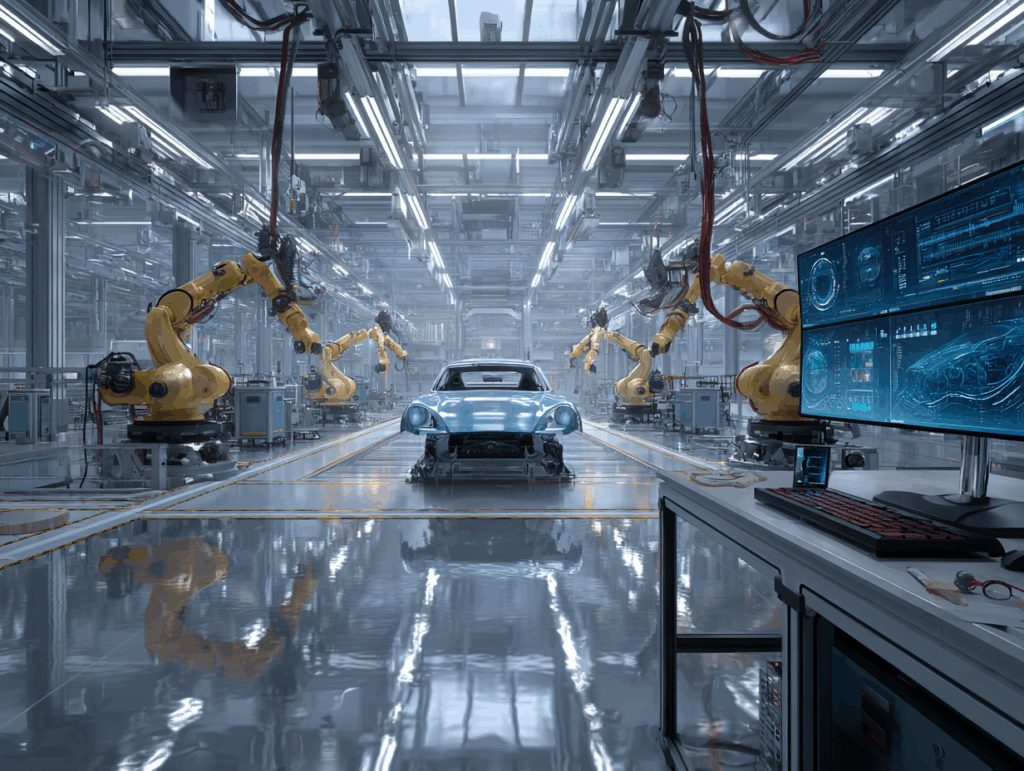

Rising Complexity Across Plants

Today’s plants are filled with advanced robotics, high-voltage EV systems, power electronics, PLC networks, vision systems, AMRs and AGVs, battery pack lines, and increasingly software-driven processes. The skill requirements have grown rapidly, but the capability of the incoming workforce has not kept pace.

More Technology, Fewer People Who Can Run It

EV platforms, ADAS modules, and software-defined architectures introduce new testing, assembly, and diagnostic demands. Battery lines and power electronics require specialized knowledge. And predictive maintenance, AI, and digital twins only create value if the workforce can operate, interpret, and respond to them.

Why This Has Become a Strategic Threat

Direct Impact on Uptime and Throughput

Skilled maintenance shortages immediately translate into longer downtime events, inconsistent shift performance, and unstable throughput. A single unresolved issue can cascade into hours of lost production—especially in tightly sequenced EV and powertrain operations.

Quality and Safety Risks

Inexperienced staff increases the risk of assembly defects, misaligned processes, and errors in high-voltage and electronics operations. Tribal knowledge—much of it undocumented—is leaving plants as senior technicians retire.

Transformation Efforts Lose Momentum

Some OEMs are investing in automation and digital transformation, but these initiatives often stall when the workforce cannot absorb new technologies. The tools may exist, but the capability to run them consistently across shifts and sites is not yet in place. This mismatch between technology ambition and workforce readiness will be explored further in a future topic.

Symptoms OEMs Are Seeing Today

Across the industry, the same patterns keep repeating:

- Persistent understaffing in skilled trades and maintenance roles

- Heavy reliance on contract labor with inconsistent standards

- High turnover among PLC technicians, robotics specialists, and EV-related roles

- Corrective maintenance overshadowing preventive and predictive efforts

- Inconsistent work instructions, procedures, and troubleshooting approaches across shifts

- Difficulty scaling digital or automation pilots across plants

These are not isolated issues—they are structural signs of a workforce model that no longer matches the complexity of the industry.

Why Traditional Approaches Are Not Working

Hiring Alone Will Not Solve It

The competition for skilled technical labor spans semiconductor, aerospace, logistics, energy, and advanced manufacturing. Raising wages alone does not create new talent, and contractors fill gaps but rarely build long-term capability.

Training Is Not Keeping Up With the Technology Curve

Most OEMs still rely on classroom-based training disconnected from real equipment. Skills do not advance fast enough to match the requirements of automation-heavy EV lines and software-driven systems.

Every Plant Operating Independently

Many OEMs still allow each site to build its own maintenance practices, skill matrices, and performance expectations. The result is inconsistent capability and widely variable operational results.

What High-Performing OEMs Are Doing Differently

The leaders are shifting from short-term staffing fixes to long-term capability development that integrates operations, training, technology, and workforce planning. They are building:

1. A Unified Technical Skills Framework Across All Plants

A consistent set of roles, certifications, and competency levels—from mechanical and electrical fundamentals to robotics, automation, and high-voltage EV systems.

2. Predictive Maintenance Talent, Not Just Predictive Maintenance Tools

Technicians trained to interpret sensor data, diagnose equipment degradation, and apply structured troubleshooting methods.

3. Modern Training Models

Simulation-based learning, AR/VR-enabled procedures, digital twins for troubleshooting, and OEM-specific technical academies that accelerate skill development.

4. Systematic Capture of Tribal Knowledge

Documenting expert procedures through video, digital workflows, and on-machine guidance to create standardized best practices across shifts and regions.

5. Strategic Partnerships, Not Transactional Ones

Collaborating with equipment suppliers, technical colleges, and integrated maintenance service partners to build long-term capability rather than short-term headcount.

A Practical Roadmap for the Next 12–24 Months

OEMs seeking near-term impact can focus on seven foundational steps:

- Assess the talent gap—skills, staffing levels, retirements, and shift-to-shift variability.

- Build a unified competency model tied to specific equipment, processes, and technologies.

- Establish an internal technical academy for EV, robotics, automation, and predictive systems.

- Deploy AR/VR and simulation-based training for complex or safety-critical operations.

- Standardize maintenance procedures and skill requirements across all plants.

- Align suppliers and partners around performance, uptime, and capability building.

- Integrate workforce capability metrics into downtime, OEE, and quality analysis.

These steps create the foundation for consistent execution, stable operations, and faster adoption of new technologies.

Conclusion: Talent Is Now a Competitive Advantage

The automotive industry is transforming faster than its workforce can evolve. Technology will continue to accelerate, but without a skilled and reliable technical workforce, the value of that technology will go unrealized.

OEMs that treat talent as a strategic capability—not a staffing problem—will hold a structural advantage in uptime, quality, cost, and transformation speed. Those that do not will find themselves constrained, regardless of how advanced their technology roadmap appears on paper.

In the decade ahead, skilled labor is not just a requirement—it is a core differentiator.