Creating Financial Planning Infrastructure for Growing Organizations

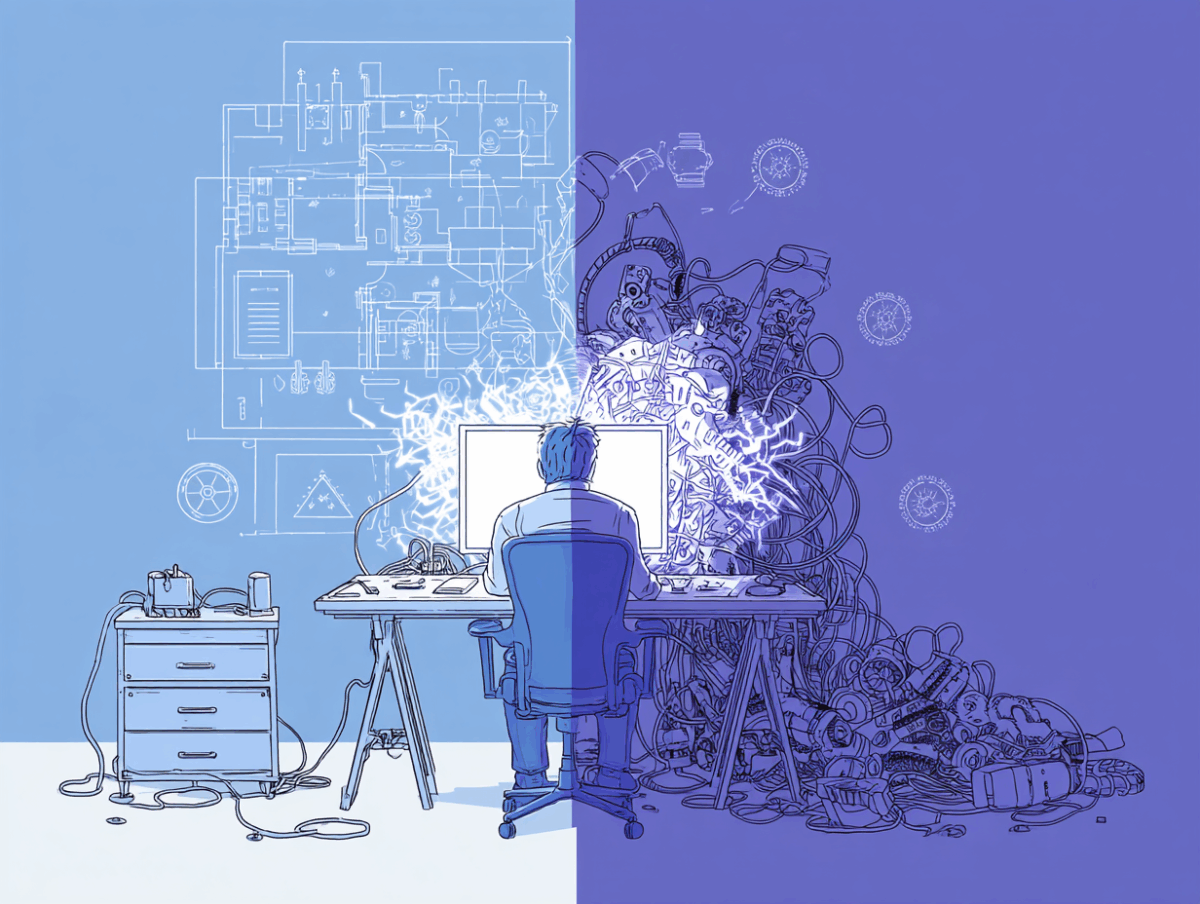

The leadership team is strong. The CFO and CEO are seasoned executives. Department heads bring impressive track records from prior companies. Yet the first few planning cycles are chaotic. Forecasts don’t align. Assumptions conflict across departments. Finance scrambles to reconcile numbers that should connect naturally. The problem isn’t capability. It’s integration.

After working with PE-backed portfolio companies on annual planning and budgeting, we observe a recurring pattern: experienced leaders who are new to each other, new to the business specifics, and operating without the integrated planning processes necessary to deliver PE-grade forecasts.

The Real Challenge: Integration, Not Competence

When newly formed leadership teams struggle with financial planning, the knee-jerk reaction is to blame skills or effort. But that’s wrong. These are capable executives who’ve successfully forecasted at other companies. They know how to build budgets and defend projections. They understand financial planning fundamentals.

What they don’t have yet:

- Shared understanding of the business: New leaders are still learning customer dynamics, product roadmaps, go-to-market rhythms, and operational interdependencies that drive financial outcomes

- Coordinated planning process: Each executive brings different forecasting approaches from prior companies—creating confusion about timing, formats, assumptions, and hand-offs

- Aligned assumptions: Without structured coordination, sales forecasts revenue based on different pipeline assumptions than product is planning releases for, or operations is staffing against

- Common language: Even experienced CFOs and department heads use terms differently—”committed,” “probable,” “pipeline” mean different things across companies

- Established communication rhythms: New teams haven’t built the regular touchpoints where cross-functional dependencies get surfaced and resolved before they break forecasts

This is especially acute in PE-backed companies where multiple executives often join simultaneously after a transaction or funding event. Everyone is learning together—the business, the team dynamics, and each other’s working styles.

The Reality: The challenge isn’t teaching people how to forecast. It’s creating the integrated planning infrastructure that lets experienced leaders coordinate effectively.

Why PE Ownership Raises the Stakes

In PE-backed companies, forecast accuracy isn’t just important—it’s existential.

PE sponsors base value-creation plans on reliable projections. Board members evaluate management against forecast commitments. Investment decisions, add-on acquisitions, and exit timing depend on hitting numbers consistently. This scrutiny means newly integrated teams don’t have the luxury of several planning cycles to “figure it out together.” They need to deliver credible forecasts immediately—while still learning the business and each other. The tension creates pressure:

- Department heads feel exposed presenting forecasts on businesses they’re still learning.

- Cross-functional assumptions that should align often conflict because coordination processes don’t exist yet.

- CFOs inherit forecasting approaches from predecessor teams that don’t fit current needs

- Board expectations for accuracy exceed what unintegrated teams can reliably deliver.

- Planning cycles consume excessive time because there’s no established process to follow.

Companies often respond by adding FP&A headcount or implementing new software tools. But the problem isn’t resources or technology—it’s the absence of structured planning processes that coordinate experienced people effectively.

What Integration Actually Requires

Building integrated planning capability for experienced but newly formed teams requires different solutions than basic forecasting training.

1. Define Planning Roles and Hand-offs Explicitly

Experienced executives bring different mental models of “who owns what” in planning. One leader thinks sales forecasts revenue and finance models it. Another expects finance to forecast revenue based on pipeline data sales provides. A third assumes marketing owns demand gen inputs that sales converts to bookings forecasts. All are valid approaches—but only if everyone agrees.

Integration requires explicitly defining planning ownership by function, clarifying which team provides inputs versus which owns the forecast, documenting hand-off points where one department’s outputs become another’s inputs, and establishing accountability for forecast quality at each stage. This isn’t about creating bureaucracy. It’s about making implicit assumptions explicit so experienced leaders can coordinate effectively.

2. Create Shared Planning Infrastructure

When leaders bring different planning approaches from prior companies, chaos results—even when everyone is individually competent. Integration means standardizing planning templates that capture required detail consistently, establishing reporting cadences aligned with board cycles and business rhythms, defining assumption frameworks that ensure cross-functional alignment, and documenting forecasting logic so others can validate and build on it.

The goal isn’t restricting how people think. It’s providing common infrastructure that lets different perspectives integrate into coherent company-level projections.

3. Build Communication Rhythms Around Dependencies

Financial planning is fundamentally a coordination problem. Revenue forecasts depend on product release schedules. Hiring plans depend on bookings assumptions. Customer success costs depend on revenue mix. In established teams, these dependencies get managed informally. In newly formed teams, they break silently until forecasts miss.

Integration requires monthly operating cadence where cross-functional impacts surface early, regular forecast review forums where assumption conflicts get identified and resolved, clear escalation paths when material changes affect multiple departments, and structured communication that doesn’t depend on personal relationships that don’t exist yet.

4. Align on Business Specifics That Drive Forecasts

Experienced leaders can forecast generically, but PE-grade accuracy requires understanding business-specific drivers. This means shared understanding of customer acquisition patterns and sales cycle dynamics, product development timelines and release dependencies, go-to-market effectiveness and conversion economics, operational constraints and capacity limitations, and competitive dynamics and market positioning.

Building this shared context takes time—but structured planning processes accelerate it by forcing cross-functional conversations that surface critical business knowledge.

The CFO’s Integration Challenge

CFOs in PE-backed companies face a unique challenge: they need forecast credibility immediately, but they’re working with newly integrated teams still learning the business. The temptation is taking direct control—building all forecasts in the finance team to ensure consistency and quality.

But that approach doesn’t scale and creates finance bottlenecks that slow decision-making.

The better approach: invest upfront in building integrated planning infrastructure that enables experienced operational leaders to coordinate effectively. Treat integration as a process design problem, not a capability gap. This means facilitating cross-functional planning sessions where assumptions get aligned, creating templates and frameworks that guide coordination, establishing communication rhythms before they’re strictly necessary, and coaching integration challenges without taking over forecast ownership.

What Integrated Planning Looks Like

When experienced teams have proper planning infrastructure, transformation happens quickly: Planning cycles that started chaotic become predictable and efficient. Cross-functional assumptions that conflicted become aligned through structured coordination. Forecasts that seemed arbitrary become defensible because logic and dependencies are documented. Department heads who felt exposed presenting numbers gain confidence as shared understanding improves. Most importantly, the CFO stops being the integration point for all planning coordination—the process itself handles it.

Building Integration Without Slowing Down

PE-backed companies can’t afford long integration timelines. They need experienced teams delivering accurate forecasts immediately. The answer is investing upfront in planning infrastructure—clear roles, common processes, coordination rhythms, and shared frameworks—that lets capable people work together effectively before organic integration would naturally develop.

At 212 Growth Advisors, we work with CFOs and executive teams in PE-backed companies to build integrated planning processes that coordinate experienced leaders effectively—defining planning roles and hand-offs, creating planning templates and frameworks, establishing coordination rhythms and communication cadences, and facilitating team integration around financial planning discipline.

If your experienced leadership team is new to each other or the business, and planning cycles aren’t delivering the forecast credibility your board expects, let’s discuss how to build the integrated planning infrastructure your team requires.